AI-Native Startups Are Growing 100%+ While Traditional SaaS Stalls at 23%—Here's Why

The 4.3x growth advantage AI-native startups hold over traditional SaaS isn't about feature velocity or funding. It's about decision ownership built into architecture from day one.

Andrew Hatfield

November 16, 2025

The Growth Divergence Nobody's Talking About

AI-native startups are achieving 100% median annual growth while traditional SaaS companies have stalled at 23% [Source: Emergence Capital, Beyond Benchmarks 2025].

That's not a rounding error. That's a 4.3x performance advantage—the largest competitive gap in B2B software since the cloud migration of the early 2010s.

And it's getting worse, not better.

While you've shipped six AI features in the past six months, AI-native competitors have raised $377B in just the first half of 2025 [Source: ICONIQ State of Software 2025, via Pitchbook]—already exceeding all of 2024's funding levels. They're reaching $100M ARR in 1-2 years with fewer than 20 employees, while traditional SaaS companies took 5-7 years with 200+ person teams to hit the same milestone.

The pattern is consistent across every ARR band. High Alpha's 2025 SaaS Benchmarks Report shows companies with AI "core to their product" growing twice as fast as those treating AI as a "supporting feature"—and the gap widens as companies scale.

Your board is asking the right question: "What makes our AI defensible?"

This isn't a feature velocity problem. It's a shift from workflow optimization to decision intelligence—and it compounds with every AI feature you ship on workflow-first infrastructure.

The Numbers Tell a Story About Architecture, Not Execution

Traditional explanations for the growth gap don't hold up under scrutiny.

It's not funding. Traditional SaaS companies raised record amounts through 2021-2023. It's not talent access—established companies have strong employer brands and competitive comp packages. It's not market timing—both groups are selling into the same buying environment.

The difference shows up most clearly in how companies allocate resources and structure teams.

AI-native companies dedicate 56% of their R&D budget to AI development versus just 28% for companies adopting AI. The gap at the extremes is even more dramatic: top-quartile AI-native companies invest 60% of R&D in AI versus just 5% for bottom-quartile adopters.

| Company Type | AI R&D Allocation |

|---|---|

| Top Quartile AI-Native | 60% of R&D budget |

| AI-Native Average | 56% of R&D budget |

| AI Adopters Average | 28% of R&D budget |

| Bottom Quartile Adopters | 5% of R&D budget |

This isn't a minor efficiency variance. It's a fundamental difference in what these companies are building.

Team composition reveals the architectural divergence:

| Function | AI-Native Companies | Traditional SaaS |

|---|---|---|

| R&D | 57% | ~35% |

| Sales & Marketing | 32% | ~45% |

| G&A | 11% | ~20% |

AI-native companies maintain 57% R&D, 32% sales and marketing, 11% G&A. They're engineering-led organizations optimized for technical problem-solving, not GTM execution.

Traditional SaaS flips this ratio, allocating more headcount to customer acquisition and support because workflow software requires extensive change management. AI-native products that own decisions require less hand-holding—the value is in the outcome, not the workflow.

High Alpha's data shows the architectural choice compounds over time. Companies that embed AI as core to their product—not as a supporting feature—achieve these median growth rates across ARR bands:

| ARR Band | AI Core to Product | AI as Supporting Feature | Growth Gap |

|---|---|---|---|

| $1-5M | 70% | 40% | 1.75x |

| $5-20M | 50% | 30% | 1.67x |

| $20-50M | 40% | 30% | 1.33x |

The narrowing gap at scale isn't convergence—it's mathematics. High-percentage growth becomes harder as the base grows. But AI-core companies maintain structural advantages in ARR per employee and customer acquisition efficiency that traditional SaaS can't match through optimization.

Why Decision Intelligence Creates Compounding Advantages

The growth gap stems from a fundamental value proposition difference.

Traditional SaaS optimizes workflows. AI-native companies own decisions.

This distinction matters more than most product leaders realize. When you add a copilot feature to help users complete tasks faster, you're improving efficiency within existing workflows. When an AI-native competitor ships a captain feature that makes decisions and executes outcomes, they're changing the value exchange entirely.

One approach sells "do your job better." The other sells "we do it for you."

But decision intelligence doesn't mean better analytics or smarter recommendations. It means decision ownership—your product makes the decision, takes the action, delivers the outcome. The architecture that enables this requires three layers most companies skip.

The architectural requirements are completely different:

| Requirement | Workflow Optimization | Decision Ownership |

|---|---|---|

| Primary Focus | User interface for task completion | Proprietary data to inform decisions |

| Integration | Existing tools and processes | Explainability and trust mechanisms |

| Change Management | Training programs required | Continuous learning from outcomes |

| Pricing Model | Seat-based, tied to adoption | Value-based, tied to results |

| Success Metric | Time saved | Accuracy and impact |

| User Role | User executes with AI assistance | AI executes, user validates |

Traditional SaaS companies retrofitting AI features onto workflow products face technical debt that AI-natives never incur. Every existing workflow assumption baked into the product architecture fights against decision ownership.

This is one component of the Triple Squeeze. AI-native competitive pressure combines with customer DIY through vibe coding and platform dependency to create three coordinated threats that compound when companies add AI features without transforming their architecture.

The data shows AI-native companies maintain dramatically higher new logo velocity: 360% year-over-year growth in new customer acquisition versus 24% for traditional SaaS in the under-$100M ARR segment. They're not just growing faster with existing customers—they're acquiring new customers at 15x the rate.

This velocity advantage stems from lower friction in the sales process. Products built for decision ownership often "sell themselves" through superior outcomes. Workflow products require extensive demos, change management discussions, and ROI justification.

ICONIQ's data shows AI-native companies achieve 1.6x better net magic number (sales efficiency metric) in the under-$100M ARR range versus traditional SaaS. They generate more revenue per dollar of sales and marketing spend because the value proposition is clearer and the buying process faster.

The Compounding Dynamics That Widen the Gap

The 4.3x growth advantage isn't static. The structural differences create feedback loops that accelerate divergence over time.

Investment Capacity: AI-native companies growing at 100% can maintain 56% R&D allocation while traditional SaaS companies at 23% growth face pressure to increase sales and marketing spend to maintain growth rates. The faster-growing company can invest more in product while the slower-growing company must invest more in GTM.

Talent Magnetism: Top AI engineers want to build AI-first, not retrofit AI features into legacy architectures. AI-native companies can attract premium talent despite smaller brand recognition because the technical work is more interesting. Our September 2025 survey found engineering leaders consistently cited "greenfield AI architecture" as a top decision factor in joining startups over established companies.

Customer Expectations: Markets recalibrate quickly. What seemed innovative 18 months ago (AI-powered search, smart recommendations) is now table stakes. Buyers increasingly expect decision intelligence, not workflow optimization with AI assistance. AI-native companies set these expectations; traditional SaaS must meet them while transforming underlying architecture.

Platform Learning Asymmetry: This is the most insidious dynamic. Traditional SaaS companies building on proprietary foundation model APIs (OpenAI, Anthropic, Google, et cetera) teach platform providers their workflows with every API call.

Here's how the cycle works: You build a copilot feature. Your customers use it. The foundation model learns from every interaction. When the provider updates the model, every competitor using that same model inherits the improvements—including the insights your customers taught it. You funded the training. Everyone benefits.

Worse, when OpenAI, Anthropic, or Google see enough usage patterns around a specific workflow, they build it natively. Your copilot feature becomes redundant overnight.

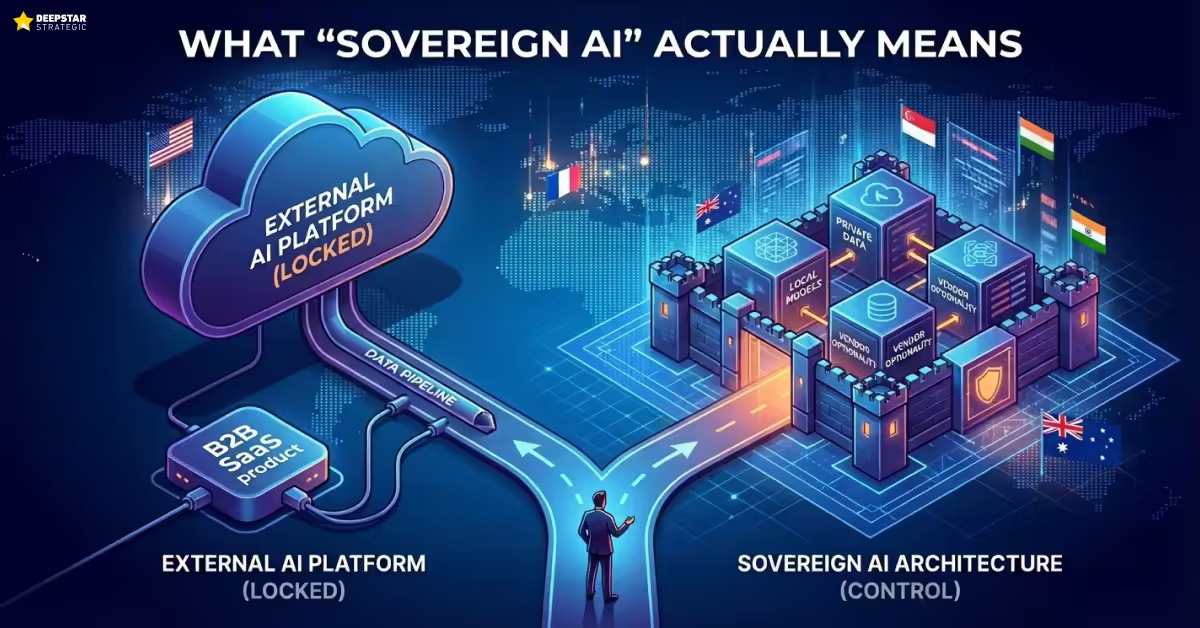

AI-native companies architecting for platform independence through open models or proprietary data layers retain competitive intelligence. They own what they learn. Nations are making identical strategic calculations—France committed €109 billion to AI infrastructure sovereignty, treating dependency on external AI providers as an existential risk. If governments analyze platform dependency and conclude it's strategically unacceptable, what does that say about SaaS companies treating 83% API dependency as "manageable"?

Our survey data revealed 83% of traditional SaaS companies report high dependency on proprietary foundation model APIs for core product features, yet most rate this dependency as moderate or low strategic risk (Deepstar Strategic, September 2025 CPO/CTO Survey). This dependency blindness compounds the vulnerability—companies don't see the risk because it's so pervasive.

Meanwhile, High Alpha's data shows AI-native companies achieving 50% higher ARR per employee at scale (over $50M ARR: upper quartile reaches $396,635 per employee). This isn't just efficiency—it's architectural leverage. Decision systems scale differently than workflow systems.

The monetization layer reveals this architectural divergence clearly. While traditional SaaS optimizes subscription economics for human buyers, AI-native companies can architect for transactional agent commerce from day one—capturing revenue from autonomous buyers that subscription models can't serve efficiently.

The performance divergence shows up across every metric:

| Metric | AI-Native Companies | Traditional SaaS | Advantage |

|---|---|---|---|

| Median Growth Rate | 100% | 23% | 4.3x |

| New Logo Velocity | 360% YoY | 24% YoY | 15x |

| Sales Efficiency (Magic Number) | 1.6x better | Baseline | 60% higher |

| ARR per Employee (>$50M ARR) | $396,635 | ~$265,000 | 50% higher |

| R&D to AI Allocation | 56% | 28% | 2x |

This is one dimension of the Triple Squeeze—AI-native competitive pressure compounds with customer DIY capabilities and platform dependency to create an inescapable cycle.

What This Means for Your AI Strategy

The strategic implication isn't "ship more AI features faster."

It's "are we architected to own decisions or just optimize workflows?"

High Alpha's benchmarking data makes this distinction concrete. The growth divergence widens through the critical $1-20M ARR scaling phase:

| ARR Range | Decision Intelligence (Core to Product) | Workflow Enhancement (AI as Feature) | Growth Gap |

|---|---|---|---|

| Less than $1M | 100%+ | 100% | Even start |

| $1-5M | 70% | 40% | 1.75x advantage |

| $5-20M | 50% | 30% | 1.67x advantage |

| $20-50M | 40% | 30% | 1.33x advantage |

The architecture choice determines whether you're on the 100% trajectory or the 23% trajectory.

And here's the timeline compression that makes this urgent: previous platform consolidation cycles gave companies 5-7 years to recognize the pattern and respond. Microsoft took 5-7 years to consolidate their ecosystem. AWS took 3-5 years. Based on current AI-native funding velocity and customer adoption rates, you have 12-18 months before architectural decisions become too expensive to change.

Our research with product and engineering leaders found 70% acknowledge competitive pressure from AI, yet most continue building on architectures designed for the pre-AI era.

One Chief Product Officer captured the dynamic:

Our direct competitors feature AI very prominently in their value prop. I do feel pressure to implement AI in substantive ways to make claims of parity in the market.

Parity. That's the language of commoditization, not differentiation.

The companies that will lead the next decade aren't adding AI features to workflow products. They're transforming their business models to own decision intelligence built on proprietary data.

From Metrics to Mindset: The Architectural Question

The 100% versus 23% gap isn't about execution speed or funding rounds.

It's about architectural intent.

AI-native companies asked "what decisions should we own?" before writing their first line of code. Traditional SaaS companies are asking "which workflows should we add AI to?" while maintaining legacy architecture.

Different questions lead to different systems. Different systems create different growth trajectories. Different trajectories compound into different outcomes.

The data reveals a pattern that's played out in every platform consolidation cycle: the companies that architect for the new paradigm early become category leaders. The companies that optimize within the old paradigm become high-margin customers for platform providers.

Your AI features might be shipping on schedule. Your roadmap might include decision intelligence capabilities. Your team might be executing flawlessly.

But if your architecture is still optimized for workflow enhancement rather than decision ownership, you're in a sprint race when the field is running a marathon.

And AI-native competitive pressure is only one threat. The Triple Squeeze shows how customer DIY and platform dependency compound this challenge—three forces that accelerate together, not separately.

The question facing B2B SaaS product leaders isn't "how do we grow faster?"

It's "are we building copilots or captains?"

Copilots help users work faster within existing workflows. They reduce friction, improve efficiency, and optimize task completion. They're valuable. But they're vulnerable to platform commoditization because they're built on the same foundational models everyone else uses.

Captains own decisions and deliver outcomes. They analyze context, make informed choices, and take action without constant human direction. They're harder to build, but they create compounding advantages because they require proprietary intelligence to work effectively. Here's the methodology for building them.

The ratio of copilots to captains in your AI roadmap reveals whether you're architected for the AI-native paradigm or optimizing within the legacy model.

Most product teams haven't systematically analyzed this ratio. They're shipping features based on customer requests, competitive parity, and roadmap velocity without examining the architectural implications.

We built an assessment that analyzes up to 20 features from your AI roadmap to determine whether you're building copilots or captains. It takes five minutes and provides immediate clarity on whether your architecture creates compounding advantages or compounding vulnerabilities.

No email required. No sales call. Just pattern recognition applied to your specific roadmap.

Are You Building Copilots or Captains?Are You Building Copilots or Captains?

Assess whether your AI features optimize workflows anyone can copy or own decisions only you can make.

Let's Discuss Your AI StrategyLet's Discuss Your AI Strategy

30-minute discovery call to explore your AI transformation challenges, competitive positioning, and strategic priorities. No pressure—just a conversation about whether platform independence makes sense for your business.

Dive deeper into the state of SaaS in the age of AI

Understand the market forces reshaping SaaS—from platform consolidation to AI-native competition

The State of SaaS in the Age of AIThe Constraint Nobody's Modeling

The State of SaaS in the Age of AIThe Constraint Nobody's ModelingEvery AI sovereignty strategy makes the same assumption: when you're ready to build independence, the resources will be available. Analyze the economics and you'll find that assumption is wrong. Compute is concentrating. Talent is concentrating. Policy is unstable. The window is closing.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for Allies

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for AlliesOpenAI's 'sovereign deployment options' sound like independence. The US government's AI Action Plan describes these as partnerships. Read the actual documents and you'll find explicit language about 'exporting American AI to allies.' That's not a sovereignty framework—it's a dependency architecture with better PR.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS Companies

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS CompaniesFrance, Singapore, India, and the UK collectively spent tens of millions developing AI sovereignty strategies. The conclusions are public. They translate directly to your product architecture decisions. Most SaaS product teams haven't read a single one.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product Strategy

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product StrategyFrance is spending €109 billion on AI infrastructure. Singapore admits GPUs are in short supply and they face 'intense global competition' to access them. Your product team is debating whether to increase OpenAI API spend by 20%. These aren't different conversations—they're the same conversation at different scales.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025