The Triple Squeeze: Why Your AI Strategy Is Under Attack From Three Directions Simultaneously

Your board asked last quarter what makes your AI defensible. You shipped six new AI features since then. The answer is still unclear.

Andrew Hatfield

November 14, 2025

The Compounding Threat Most SaaS Leaders Don't See Coming

You're experiencing competitive pressure. You know that much.

AI-native startups are showing up in deals you used to win easily. Customers are mentioning they "built something internally that works." Your dependency on OpenAI or Anthropic APIs keeps growing while your differentiation keeps shrinking.

Most CPOs and CTOs treat these as separate challenges requiring separate responses. Ship AI features faster to match the startups. Improve the product to reduce churn risk from customer DIY. Optimize API costs to manage the dependency.

But these aren't three separate problems. They're one compounding squeeze—and the faster you respond to the symptoms, the worse the underlying condition becomes.

Our September 2025 survey of 30 CPOs and CTOs at B2B SaaS companies revealed a pattern that explains why. While 83% report high dependency on proprietary foundation model APIs for core product features, most assessed this dependency as moderate or low strategic risk. One CTO told us directly:

I personally am not worried about data leaking to the models.

It's textbook dependency blindness. The risk is so pervasive it becomes invisible.

The risk extends beyond competitive intelligence. In November 2025, a breach at Mixpanel—an analytics vendor in OpenAI's ecosystem—exposed API customer data including names, emails, and organization IDs. OpenAI correctly noted it wasn't their breach. But their customers' data was still compromised through a vendor they'd never evaluated. Platform dependency doesn't just create competitive exposure—it expands your security surface area to include every vendor in your provider's supply chain.

This isn't the first time platform consolidation has caught successful companies off guard. I've watched this pattern destroy independent software companies multiple times over 30 years—Microsoft's embrace/extend/extinguish in the 1990s, Google's search-to-compete strategy in the 2000s, AWS's observe/copy/integrate in the 2010s, Meta's copy-or-acquire throughout the 2010s-2020s, and now OpenAI's emerging learn/build/obsolete pattern.

Each cycle compressed the timeline. Microsoft took 5-7 years to consolidate their ecosystem. AWS took 3-5 years. OpenAI is compressing it to 12-18 months.

| Company | Cycle Duration | Visual |

|---|---|---|

| Microsoft (1990s) | 5–7 years | ████████████████ |

| AWS (2010s) | 3–5 years | ██████████ |

| Google (2000s) | 4–6 years (ongoing) | ████████████+ |

| Meta (2010s–20s) | 18–24 months | █████ |

| OpenAI (2024–25) | 12–18 months | ███ |

The companies that survived previous cycles didn't optimize faster within the doomed paradigm. They recognized the architectural vulnerability early and transformed before the squeeze became inescapable.

In AI, this transformation means shifting from workflow optimization to decision intelligence—and specifically, to decision ownership where your product makes decisions and owns outcomes, not just helps users work faster.

Understanding the Triple Squeeze

The competitive pressure you're feeling isn't coming from three random directions. It's three coordinated threats that reinforce each other, creating a feedback loop that accelerates with every AI feature you ship.

Threat 1: AI-Native Competitive Pressure

Traditional SaaS companies are adding AI to existing workflows. AI-native startups are building decision systems from day one.

The architectural difference matters more than most product leaders realize.

When you add a copilot feature to your workflow product, you're optimizing task execution. The customer still owns the decision, you just helped them work faster. When an AI-native competitor ships a captain feature, they're owning the outcome. The system makes the decision, takes the action, delivers the result.

One approach optimizes workflows. The other achieves decision intelligence through decision ownership.

Workflow optimization is about improving efficiency. Decision ownership changes the value proposition entirely.

Vendr's 2025 SaaS Trends Report showed that despite widespread AI feature adoption, ACVs remained flat year-over-year. Net new purchases and renewals both declined compared to 2023. The market signal is clear: buyers view AI features as table stakes, not premium capabilities.

Meanwhile, AI-native companies are capturing growth that traditional SaaS is losing. The contrast is stark—while established SaaS companies report 23% growth rates, AI-native startups funded specifically to "rebuild X with AI-first architecture" are achieving 100%+ growth.

The gap isn't about feature velocity. It's about architectural intent.

AI-native companies have zero technical debt from workflow-first architecture. They're not retrofitting decision intelligence into products built for task optimization. They're architected for decisions from the foundation—unified data models, inference-first design, outcome-based pricing.

Our survey found that 70% of CPOs and CTOs acknowledge competitive pressure from AI, yet most continue building on architectures designed for the pre-AI era. One Chief Product Officer at a supply chain SaaS company told us:

Our direct competitors feature AI very prominently in their value prop. I do feel pressure to implement AI in substantive ways to make claims of parity in the market.

Parity. That's the language of commoditization, not differentiation.

The timeline for this threat is compressed. Traditional competitive cycles gave you 2-3 years to respond. AI-native startups are raising seed rounds, shipping MVPs, and winning early customers in 6-9 months. By the time you recognize them as competitive threats, they're already taking market share.

Threat 2: Customer DIY Through Vibe Coding

Your customers aren't waiting for your roadmap anymore. They're using Cursor, Lovable, Replit, and v0 to build "good enough" replacements in hours

AI coding assistants are transforming development velocity. Cursor grew from $1M to $100M revenue in a single year, while GitHub Copilot reached 20 million installs. Tools like these—plus Tabnine, Lovable, Replit, v0, and Bolt—have put AI-powered prototyping in the hands of millions of developers, product managers, analysts, and operations teams who can now build "good enough" solutions in hours instead of months.

Add workflow automation builders like n8n to the equation. Your customers have everything they need to rebuild your workflow automation, report generation, data analysis, and document processing capabilities in a weekend.

They're not building perfect replacements. They're building good enough to stop paying you.

A VP of Product at a financial services SaaS company in our survey captured the dynamic:

Prospects and customers are asking about AI—they believe it can make them 10x-100x more productive, that agents can do the grunt work on their behalf.

When customers believe AI can deliver that level of productivity improvement, and they have tools that let them prototype solutions themselves, your six-month feature roadmap becomes a retention risk.

The math is brutal. Your customer pays you $50K annually for workflow software. They spend 40 hours with Claude or Cursor to build 80% of what they need. Even at $200/hour fully loaded cost for their engineer, that's $8,000 to replace $50K in annual spend. The ROI conversation writes itself.

This isn't theoretical. Our survey revealed multiple CPOs and CTOs hearing customers say "we're building this internally" or "we prototyped something that works." One CTO at a healthcare tech company noted:

We realized that some view our AI claims as non-credible, mainly due to fear of hallucinations.

When customers don't trust your AI implementation, they'll build their own. When they build their own, they discover it's easier than they expected. When it's easier than expected, they start questioning what else they can replace.

The vibe coding threat compounds with competitive pressure. Every AI-native startup that ships a working product validates that workflows can be rebuilt quickly. Every successful prototype your customers build proves they don't need to wait for your roadmap. The architectural implications of this shift—and why workflow features are especially vulnerable—are explored in depth here.

Threat 3: Platform Provider Consolidation

While you're responding to AI-native competitors and customer DIY, every API call to OpenAI or Anthropic is teaching them your workflows.

This pattern has played out repeatedly over the past 30 years. The mechanics are always the same. The timeline keeps compressing.

Microsoft in the 1990s embraced ISV innovations on Windows, extended them with deep OS integration, then extinguished independent products through bundling. Netscape dominated browsing until Internet Explorer shipped free with Windows. Stacker led compression until DriveSpace became a Windows feature. WordPerfect controlled word processing until Word's Windows integration made it irrelevant.

The cycle took 5-7 years. Companies that recognized the pattern early—like Adobe with cross-platform architecture—survived. Companies that optimized for Windows integration became historical footnotes.

AWS in the 2010s observed what enterprises built on EC2, copied successful patterns, then integrated them as managed services. MongoDB's success led to DocumentDB. Elasticsearch became OpenSearch. Redis became ElastiCache. The pattern was predictable: if your value was "make AWS infrastructure easier to use," AWS would eventually make that native.

The cycle compressed to 3-5 years. Companies that built proprietary differentiation beyond infrastructure—Snowflake's data warehouse architecture, Databricks' unified analytics—maintained independence. Companies whose value was "hosted X" became acquisition targets or slowly declining revenue streams.

Google throughout the 2000s-2010s offered free search and analytics, learned user behavior patterns, monetized that knowledge, then built competing features. Local business listings, review platforms, travel booking, recipe sites—any vertical where Google could observe behavior patterns through search and aggregate data became vulnerable to Google building native experiences.

Companies that owned proprietary data Google couldn't replicate survived. Companies that organized public information better than Google did were gradually rendered irrelevant.

Meta in the 2010s-2020s acquired direct competitors (Instagram, WhatsApp), copied remaining threats (Stories from Snapchat, Reels from TikTok, Marketplace from Craigslist), then leveraged distribution advantages.

The pattern went beyond simple feature copying. Meta (then Facebook) partnered with Zynga to understand social gaming mechanics, watched the patterns that worked, then built their own gaming platform that competed directly. They attempted to acquire Giphy in 2020 after seeing how popular GIF sharing had become—regulators blocked the purchase, so Meta built their own Giphy-like feature into the platform instead.

The message: if Meta couldn't acquire the workflow, they'd copy it. The pattern compressed to 18-24 months from threat identification to feature launch.

Now we're watching OpenAI and Anthropic in 2024-2025 learn workflows through API usage and build native capabilities. Canvas competes with writing tools. Projects compete with knowledge management. Artifacts compete with development tools. Computer use competes with RPA and workflow automation.

But the pattern goes deeper. OpenAI launched a job board that reveals which skills companies are hiring for and which skills exist in the candidate market—positioning them to match pairs and sell in-demand training directly to job seekers. Their Agent Builder and App SDK explicitly ask you to give OpenAI your workflows and UX patterns—you're literally handing them the blueprint for competing with you. Atlas, their Chrome clone, lets OpenAI see user behavior patterns and application UX flows across the entire web.

Every integration point is an intelligence-gathering mechanism. Every API call teaches them not just what you're building, but how customers use it.

The cycle has compressed to 12-18 months from observation to native feature.

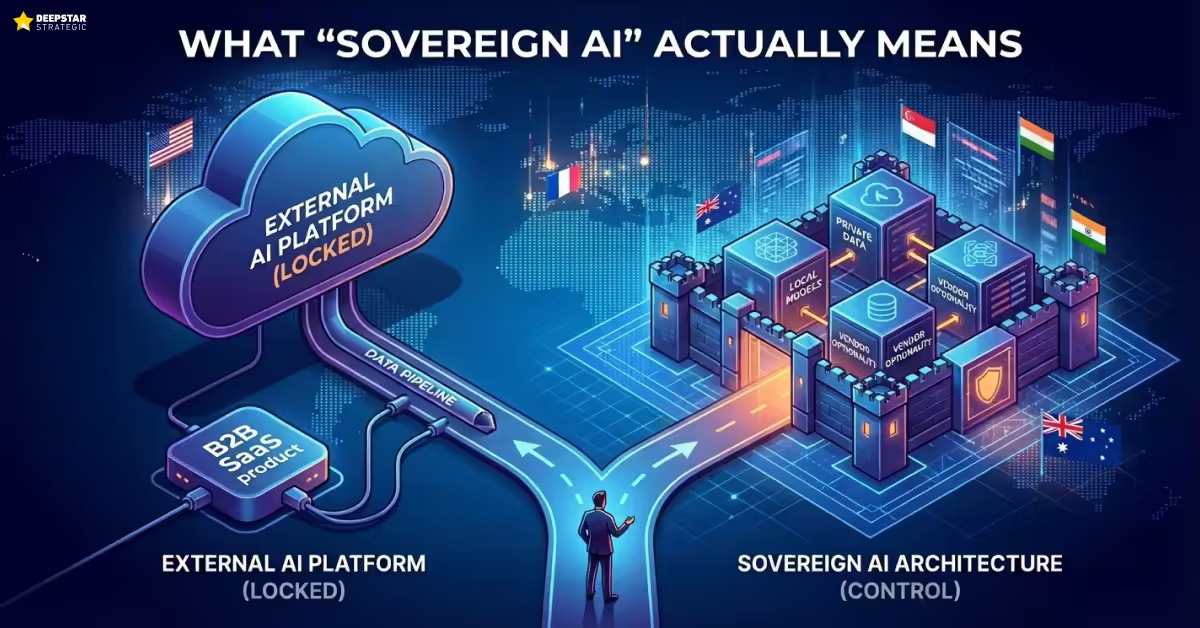

Your API dependency isn't just a cost optimization problem. It's strategic intelligence flowing to potential competitors who have better economics (no SaaS margin pressure), better data (aggregated across industries), and better models (continuous improvement from global usage). Nations are spending billions on AI infrastructure specifically to avoid this dependency—France committed €109 billion because they analyzed what happens when critical infrastructure is controlled by external parties. If governments treat AI dependency as an existential risk, why would your product team treat it as a procurement issue?

Our survey found 83% of CPOs and CTOs report high dependency on proprietary foundation model APIs. When asked about strategic risk, responses varied widely. Some acknowledged concerns about "potential data leakage, lack of transparency in how proprietary models handle inputs, and the risk of unintentionally strengthening competitors through shared training data." Others were unconcerned: "I don't think our current company maturity makes this a high-level concern."

The pattern from previous consolidation cycles suggests the unconcerned group is making the same mistake companies made with Microsoft, AWS, Google, and Meta. By the time the threat becomes obvious, the architecture that created the vulnerability is too entrenched to change quickly.

How the Three Threats Compound Into One Inescapable Squeeze

Individually, each threat seems manageable—at least through conventional responses. AI-native competitors? Most traditional SaaS companies respond by shipping AI features faster. Customer DIY? They improve the product's workflow optimization. Platform consolidation? They optimize API usage and costs.

But here's the critical mistake: these conventional responses treat the symptoms while accelerating the underlying disease.

The fundamental difference between traditional B2B SaaS and AI-native startups isn't feature velocity—it's architectural intent. Traditional products help users do work better or faster by managing and optimizing workflows and processes. AI unlocks the ability to skip the workflow entirely and just deliver the answer, or even have the system make the decision and execute it autonomously.

Traditional SaaS companies are adding AI features to workflow products—building copilots that help users work faster within existing processes. AI-native startups are building captains that own decisions and deliver outcomes without constant human direction.

This is the workflows-to-decisions transformation. And responding to competitive pressure by shipping more workflow optimization features faster only deepens your vulnerability.

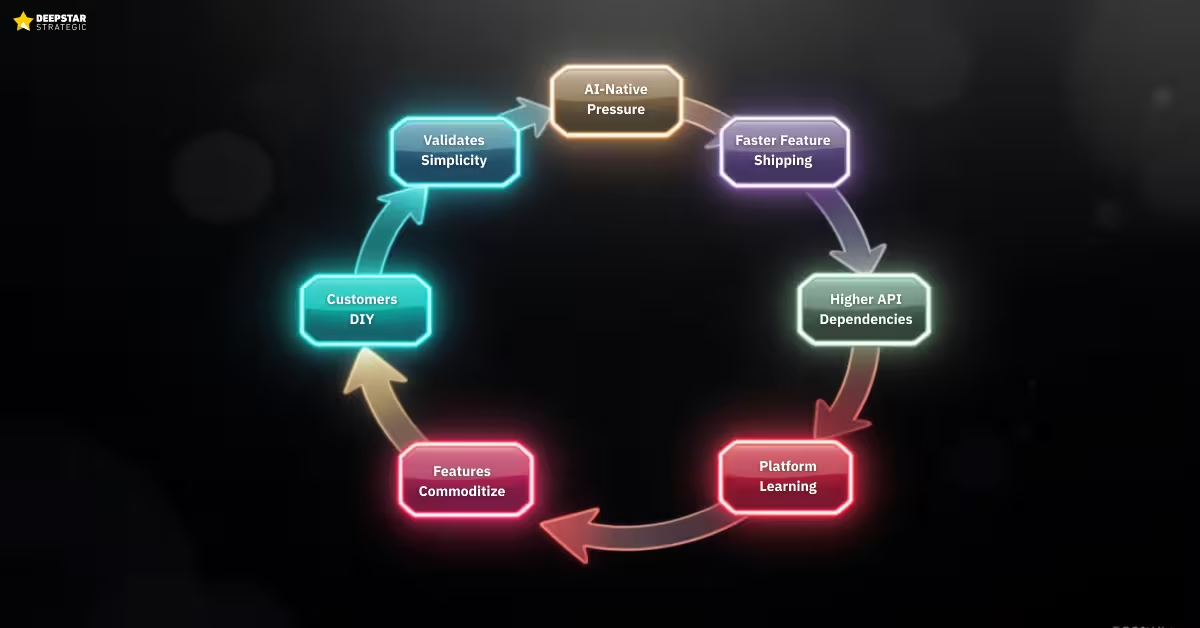

The threats don't exist in isolation. They reinforce each other in a feedback loop that accelerates with every conventional response:

AI-native competitive pressure forces you to ship AI features faster. You can't let competitors claim AI capabilities you lack. The board wants to see AI progress. Customers ask about AI in every renewal conversation. So you prioritize AI features in the roadmap.

Shipping AI features faster increases your API dependencies. Each new AI feature means more calls to proprietary foundation model providers like OpenAI or Anthropic. Your inference costs grow. Your product's core functionality becomes more tightly coupled to foundation model APIs. The dependency deepens with every feature release.

Higher API dependencies teach platform providers your workflows. Every API call reveals what problems you're solving, what inputs you're sending, what outputs customers value. Foundation model providers see aggregated patterns across thousands of companies. They learn which workflows generate the most API usage and represent the highest revenue opportunities.

Platform providers build native features that commoditize your differentiation. OpenAI launches Canvas for document editing. Anthropic ships Projects for knowledge management. Google releases Vertex AI features that replicate common SaaS patterns. What took you two years to build becomes a platform feature in their next release.

Native platform features make your product less differentiated. When foundation model providers offer 80% of your core functionality as native capabilities, your value proposition contracts. Customers start questioning why they pay you when they could use the platform directly.

Reduced differentiation makes customers more willing to build DIY replacements. If your product is primarily a workflow wrapper around foundation model APIs, customers realize they can build the workflow themselves. Tools like Cursor and Lovable lower the technical barrier. The ROI calculation tilts toward "build" instead of "buy."

Customer DIY successes validate that workflows can be rebuilt quickly. Every customer who successfully prototypes a replacement proves the workflow isn't as complex as they thought. Word spreads. Other customers try the same approach. Your retention risk compounds.

DIY validation encourages more AI-native startups. When investors see customers successfully building their own solutions, they fund startups to build commercial versions. More AI-native competitors enter the market. The cycle accelerates.

The feedback loop is complete. Competitive pressure → faster feature shipping → higher API dependency → platform learning → feature commoditization → customer DIY → more competitive pressure.

The only way to break the cycle is to step outside it entirely. But most SaaS companies are too deep in the loop to see the exit.

Why This Time Is Different: Timeline Compression, AI Economics, and Business Model Theft

If you've lived through previous platform shifts, you might think: "We've seen this before. We survived Microsoft and AWS. We'll survive OpenAI."

That confidence is precisely what makes this cycle more dangerous.

Four fundamental differences make the OpenAI/Anthropic consolidation pattern more threatening than previous cycles:

First, the timeline has compressed from years to quarters. Microsoft took 5-7 years to embrace, extend, and extinguish. AWS took 3-5 years to observe, copy, and integrate. OpenAI is compressing the pattern to 12-18 months. When Canvas launched in October 2024, it represented functionality that took writing-focused SaaS companies years to build. OpenAI shipped competitive features in months.

You don't have years to recognize the threat and respond. You have quarters. Maybe months.

Second, AI follows different economics than previous platform shifts. Cloud adoption showed exponential growth curves—initial investment paid off through compounding returns as usage scaled. AI shows logarithmic benefit curves—early gains are substantial, but each incremental improvement costs more while delivering less marginal value.

Our survey revealed this in cost frustration. A CTO at a financial services company noted:

The main frustration is cost unpredictability, especially with API calls scaling faster than planned.

A healthcare tech CPO said:

I think it's mostly around control and predictability, especially with new models becoming available all the time.

As you optimize for better AI performance, costs compound while differentiation plateaus. The economic model works against sustained competitive advantage through feature velocity alone.

Third, the dependency is invisible until it's structural. With Microsoft, companies could see Windows lock-in. With AWS, infrastructure dependencies were obvious. With AI, the dependency emerges gradually through thousands of small architectural decisions across dozens of features.

By the time the dependency becomes obvious, your product architecture assumes foundation model availability. Your customer experience depends on inference quality. Your cost structure is built around API pricing. Unwinding that dependency requires rebuilding the product, not just swapping providers.

This is why 83% high dependency combined with low perceived risk is so concerning. The architectural vulnerability compounds in the background until it's too expensive to address.

Fourth—and most critically—what's being copied is fundamentally different. In previous cycles, platform providers copied infrastructure layers and application features. Microsoft copied software tools. AWS copied infrastructure services. Google copied information organization.

OpenAI and Anthropic are copying your fundamental business processes, your value creation logic, and potentially your entire business model.

When Microsoft bundled a browser with Windows, Netscape lost distribution advantage but could theoretically differentiate through features. When AWS launched DocumentDB, MongoDB lost infrastructure convenience but retained proprietary optimization and tooling.

When OpenAI learns that your SaaS product's core value is "analyze customer support tickets and suggest responses," they can build that capability natively—and they have better data (aggregated across thousands of companies), better models (continuous improvement), and better economics (no SaaS margin requirements).

They're not copying your implementation. They're copying your reason to exist.

Previous platform shifts attacked your distribution or your infrastructure. This one attacks your fundamental value proposition.

The Pattern Recognition Advantage: What Platform Survivors Did Differently

Companies that survived previous platform consolidation cycles didn't have better technology or deeper pockets. They had better pattern recognition.

They saw the platform shift coming before it was obvious to competitors. They made architectural decisions when those decisions were still cheap to make. They prioritized independence over optimization within the dominant paradigm.

Adobe in the 1990s recognized Microsoft's embrace/extend/extinguish pattern early. Instead of optimizing Photoshop and Illustrator for Windows integration, they maintained cross-platform architecture. When Microsoft tried to bundle graphics tools with Windows, Adobe's Mac presence and cross-platform capabilities kept them independent. They survived because they refused to build solely for Windows dominance.

Snowflake in the 2010s saw AWS observing data warehouse patterns and knew native competition was coming. Instead of building "easier Redshift," they architected proprietary advantages AWS couldn't replicate—separated storage and compute, automatic scaling, cross-cloud data sharing. When AWS launched Redshift improvements, Snowflake's differentiation was architectural, not featural.

Shopify in the 2010s-2020s understood platform economics with Facebook and Google. Rather than depending entirely on these platforms for merchant traffic, they built direct merchant relationships, proprietary analytics, and owned distribution channels. When platform algorithms changed, Shopify merchants had alternative growth paths.

The pattern across survivors: recognize the consolidation risk early, architect for independence before it's urgent, build proprietary advantages the platform can't commoditize.

The companies that failed did the opposite. They optimized within the platform paradigm, assumed the platform wouldn't compete directly, and waited until the threat was obvious before responding. By then, the architecture that created the vulnerability was too entrenched to change.

The companies that recognized the pattern early and transformed their architecture maintained independence.

The Dependency Blindness Phenomenon

Our September 2025 survey of CPOs and CTOs revealed something more concerning than high API dependency. It revealed a disconnect between acknowledged dependency and perceived risk.

When we asked about dependency on proprietary foundation model APIs, 83% scored it 5-7 on a 1-10 scale. High dependency, clearly recognized.

When we asked about the strategic risk this dependency poses to competitive advantage and defensibility, responses ranged from 1 to 7. Many scored it moderate to low risk despite high dependency.

| Metric | Survey Result | Interpretation |

|---|---|---|

| API Dependency Level | 83% scored 5-7/10 (high dependency) | Clearly recognized and acknowledged |

| Perceived Strategic Risk | Responses ranged 1-7/10 (mixed perception) | Many view as moderate-to-low risk |

| The Gap | High dependency + Low risk awareness | Dependency blindness |

This is dependency blindness in action. The dependency is so pervasive it stops feeling like risk.

One CPO at a supply chain SaaS company told us:

I don't think that our current company maturity or that of our competitors makes this a particularly high-level concern. Additionally, the specific customizations we would make are largely relative to publicly available domain-specific information.

Another CTO said:

I personally am not worried about data leaking to the models/APIs. I am more worried about security issues related to MCP servers/endpoints.

These responses mirror what companies said about Microsoft in the 1990s ("we're adding real value on top of Windows"), about AWS in the 2010s ("our IP is in the application layer, not infrastructure"), and about Google in the 2000s ("we're aggregating public information they can't replicate").

The pattern is predictable: high dependency feels safe because everyone has high dependency. Competitive vulnerability feels distant because current differentiation seems durable. Strategic risk feels manageable because the platform provider isn't competing yet.

Until they are.

Microsoft didn't compete with Netscape until they did. AWS didn't compete with MongoDB until they did. Google didn't compete with review sites until they did. OpenAI doesn't compete with your SaaS product—until they do.

By the time the competition becomes obvious, the architectural decisions that created the vulnerability have been compounding for 18-24 months. Unwinding them isn't a sprint project. It's a transformation program.

What This Means for Your AI Strategy

If you're a CPO or CTO at a B2B SaaS company, the Triple Squeeze isn't a future scenario. It's your current operating environment.

You're experiencing competitive pressure from AI-native startups that forces faster feature shipping. Faster feature shipping increases your foundation model API dependencies. Those dependencies teach platform providers your workflows while giving customers confidence to build DIY alternatives. Customer DIY validates the workflow simplicity, encouraging more AI-native startups. The cycle compounds.

The survey data suggests most product and engineering leaders recognize individual symptoms but don't see the compounding pattern. They're optimizing within the squeeze instead of architecting for escape.

This parallels every previous platform consolidation cycle. The companies that optimized Microsoft integration, AWS infrastructure usage, or Google search visibility achieved incremental improvements while their strategic position eroded. The companies that recognized the pattern early and transformed their architecture maintained independence.

The critical difference now is timeline compression. You don't have 3-5 years to recognize the pattern and respond. You have 12-18 months before architectural decisions become too expensive to change.

This isn't just threat avoidance—it's arbitrage opportunity. Transition periods reward disproportionately. The companies that recognized cloud infrastructure implications in 2008 didn't just survive—they became Salesforce, Workday, ServiceNow. The companies that recognized mobile implications in 2009 didn't just adapt—they became the dominant consumer platforms. The value capture happens during the transition, not after. Once the new architecture becomes obvious, the opportunity to build dominant positions closes. You're not just racing against competitive threats. You're racing against the window where architectural bets create outsized returns.

Infrastructure developments are accelerating this compression. When AI agents gained the ability to make autonomous payments in November 2025, the assumption that human buyers control purchasing decisions became optional—not mandatory. Payment infrastructure is now agent-native, which means the entire SaaS distribution and monetization stack is being rebuilt for autonomous buyers.

The High-Performance Paradox: Why GTM Winners Are Most Vulnerable

Here's a counterintuitive reality that makes the Triple Squeeze more insidious: companies with the strongest GTM performance are often at highest risk.

While most B2B SaaS companies are experiencing declining GTM efficiency—longer sales cycles, higher CAC, compressed win rates—the highest-performing companies are seeing the opposite. Their sales velocity is strong. Customer adoption is healthy. Revenue growth continues.

This success creates strategic blindness.

When your GTM engine is performing well, it's harder to see the architectural vulnerability underneath. Strong sales mask the fact that you're winning deals based on workflow optimization in a category that's shifting to decision intelligence. High retention obscures that customers haven't yet discovered how easily they could rebuild your core functionality.

The companies most likely to recognize the Triple Squeeze early are those already experiencing GTM pressure—they're looking for explanations and are more open to challenging their assumptions. The companies least likely to recognize it are those whose current success validates their current approach.

Until it doesn't.

By the time high-performing companies feel the squeeze, AI-native competitors have already captured the growth market, customers have already started DIY explorations, and platform providers have already learned the high-value workflows. The GTM engine that was your advantage becomes an anchor—optimized for a value proposition that's being commoditized.

This is why pattern recognition matters more than current performance. The question isn't "are we winning today?" It's "are we architected to win tomorrow?"

Three questions determine whether you're architecting for independence or training your replacement:

First: Are you building copilots or captains? Copilots help users complete workflows faster. Captains make decisions and own outcomes. Copilots optimize your existing architecture. Captains require transformation to decision intelligence. The architectural implications are fundamentally different.

Second: Are your API dependencies growing faster than your proprietary differentiation? Every new AI feature that depends on proprietary foundation model providers increases your strategic vulnerability. The question isn't whether you use foundation models—everyone does. The question is whether the intelligence that creates competitive advantage lives in your proprietary data layer or in API calls to shared infrastructure.

Third: Would your customers recognize your product's unique value if platform providers launched native versions of your core features? If your differentiation is primarily workflow design around foundation model capabilities, you're vulnerable. If your differentiation is proprietary intelligence that compounds with usage, you have defensibility.

The answers to these questions reveal whether you're experiencing the Triple Squeeze or just feeling generic competitive pressure.

Copilots Optimize Workflows. Captains Make Decisions. Which Are You Building?

Understanding the Triple Squeeze is one thing. Understanding whether your AI features make you more vulnerable or more defensible is another.

We built an assessment that analyzes your AI feature roadmap to determine whether you're building copilots (workflow optimization) or captains (decision systems). Enter up to 20 AI features from your product, and the assessment categorizes each one based on its architectural implications.

Copilots help users work faster within existing workflows. They reduce friction, improve efficiency, and optimize task completion. They're valuable, but they're also vulnerable to platform commoditization because they optimize shared infrastructure.

Captains own decisions and deliver outcomes. They analyze context, make informed choices, and take action without constant human direction. They're harder to build, but they create compounding advantages because they require proprietary intelligence to work effectively. Building captain systems requires a specific three-layer architecture most teams skip.

The ratio matters more than you think. If your AI roadmap is 90% copilots and 10% captains, you're optimizing within the squeeze. If it's shifting toward decision intelligence, you're architecting for independence.

The assessment analyzes whether your roadmap is building toward decision intelligence through decision ownership, or optimizing workflows with AI features. Five minutes for strategic clarity—no email required.

Are You Building Copilots or Captains?Are You Building Copilots or Captains?

Assess whether your AI features optimize workflows anyone can copy or own decisions only you can make.

The Independence Architecture

Every platform consolidation cycle rewards early architectural independence and punishes optimization within the doomed paradigm.

The companies that survived Microsoft didn't build better Windows applications—they built cross-platform architectures. The companies that survived AWS didn't optimize their EC2 usage—they built proprietary data layers and differentiated analytics. The companies that survived Google didn't SEO harder—they built direct relationships and owned distribution.

The companies that will survive OpenAI won't ship better AI features—they'll architect for platform independence from day one.

The Triple Squeeze isn't coming. It's here. AI-native competitors are already capturing growth traditional SaaS is losing. Customers are already building DIY replacements with tools that launched in the last 18 months. Platform providers are already learning your workflows from API call patterns.

The only question is whether you're architecting for independence or training your replacement.

The difference between those outcomes isn't feature velocity or engineering resources. It's pattern recognition and architectural intent.

Every platform consolidation cycle gives independent companies 12-24 months to recognize the pattern and transform before the squeeze becomes inescapable. Most don't see the pattern until it's too late. The ones who do become the category leaders of the next cycle.

Which will you be?

Let's Discuss Your AI StrategyLet's Discuss Your AI Strategy

30-minute discovery call to explore your AI transformation challenges, competitive positioning, and strategic priorities. No pressure—just a conversation about whether platform independence makes sense for your business.

Dive deeper into the state of SaaS in the age of AI

Understand the market forces reshaping SaaS—from platform consolidation to AI-native competition

The State of SaaS in the Age of AIThe Constraint Nobody's Modeling

The State of SaaS in the Age of AIThe Constraint Nobody's ModelingEvery AI sovereignty strategy makes the same assumption: when you're ready to build independence, the resources will be available. Analyze the economics and you'll find that assumption is wrong. Compute is concentrating. Talent is concentrating. Policy is unstable. The window is closing.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for Allies

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for AlliesOpenAI's 'sovereign deployment options' sound like independence. The US government's AI Action Plan describes these as partnerships. Read the actual documents and you'll find explicit language about 'exporting American AI to allies.' That's not a sovereignty framework—it's a dependency architecture with better PR.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS Companies

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS CompaniesFrance, Singapore, India, and the UK collectively spent tens of millions developing AI sovereignty strategies. The conclusions are public. They translate directly to your product architecture decisions. Most SaaS product teams haven't read a single one.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product Strategy

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product StrategyFrance is spending €109 billion on AI infrastructure. Singapore admits GPUs are in short supply and they face 'intense global competition' to access them. Your product team is debating whether to increase OpenAI API spend by 20%. These aren't different conversations—they're the same conversation at different scales.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025