From AI Features to AI Transformation: The Architecture Shift SaaS Companies Are Missing

Most SaaS companies think AI transformation means adding AI features. They're optimizing the wrong vector—and the faster they ship, the faster they train their replacement.

Andrew Hatfield

December 4, 2025

The Wrong Vector at Maximum Velocity

Your roadmap is full of AI features. Copilots that draft content, assistants that summarize documents, automation that handles routine tasks. Every sprint ships something with "AI-powered" in the release notes. Your engineering team has integrated OpenAI for search, Anthropic for recommendations, Google for classification.

Your competitors' roadmaps look identical.

Here's what most product leaders haven't confronted: the faster you ship AI features, the faster you're training your customers to replace you and your platform providers to compete with you. AI-native startups are achieving 100% median growth while traditional SaaS stalls at 23%. That's a 4.3x performance advantage—the largest competitive gap in B2B software since cloud migration.

The gap isn't about feature velocity. It's about what those features actually build toward.

I've watched 47 B2B SaaS companies attempt AI transformation over the past 18 months. The pattern is consistent. Companies shipping copilot features fastest show the weakest competitive differentiation 12 months later. Companies taking a slower, more architectural approach build advantages that compound.

If you haven't recognized the Triple Squeeze threatening your AI strategy, the transformation path won't make sense. Three forces are compounding simultaneously: AI-native competitive pressure, customer DIY through vibe coding, and platform provider consolidation. The faster you respond to any one of these with feature shipping, the worse the other two become.

Most SaaS companies think AI transformation means adding AI capabilities to existing products. They're optimizing the wrong vector entirely.

AI adoption means adding AI features to existing workflows. AI transformation means rebuilding your product around decisions instead of processes.

The companies building 2-3x valuation advantages aren't shipping more copilots. They're building systems that own decisions—systems that make recommendations customers trust without verification, capture proprietary intelligence with every interaction, and create moats competitors can't replicate by calling the same APIs.

The Feature Trap

The MIT NANDA research validates what I've observed across dozens of companies: 95% of AI implementations deliver zero measurable ROI. Not because the technology doesn't work—it does—but because companies are optimizing workflows when they should be replacing them.

Why AI Features Become Commoditized

AI features added today become table stakes within 6-12 months. When you ship an AI copilot, you validate the workflow is simple enough to automate. Competitors, customers, and platform providers all have access to the same foundation models. Your differentiation window closes before you've captured the value.

Vendr's 2025 SaaS Trends Report showed that despite widespread AI feature adoption, ACVs remained flat year-over-year. Net new purchases and renewals both declined compared to 2023. Buyers view AI features as table stakes, not premium capabilities. The market has already adjusted its expectations.

The Copilot Ceiling

Most AI features are copilots—they help users complete workflows faster. They reduce friction, suggest next steps, automate repetitive tasks, and optimize existing processes. They're valuable. But they hit a ceiling.

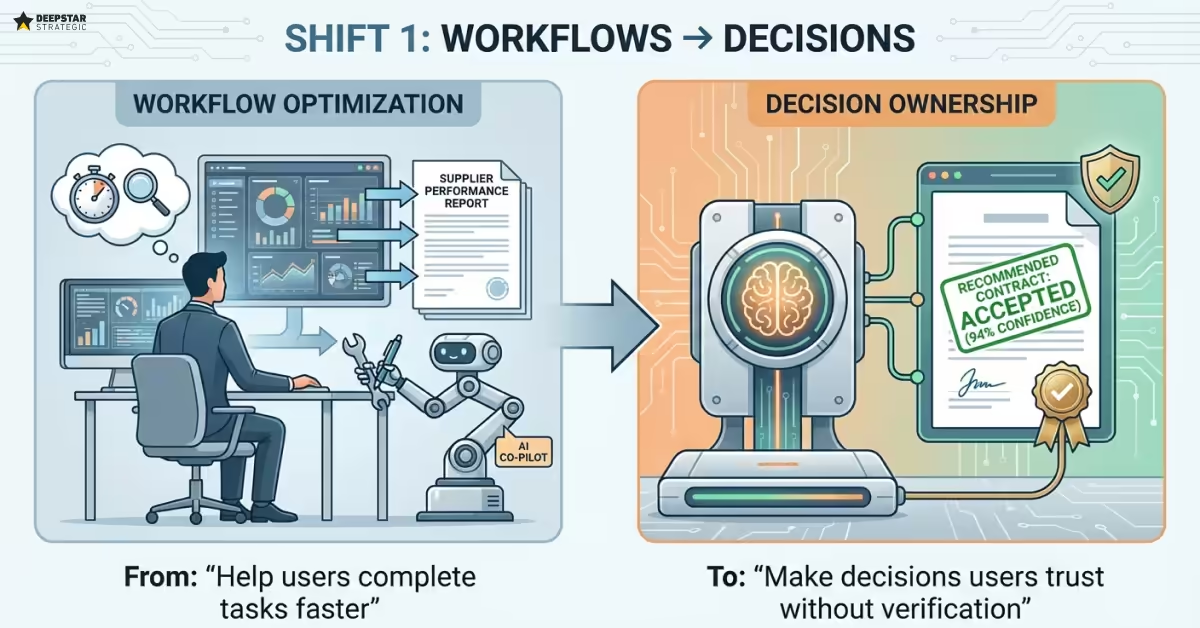

Copilots don't change the value proposition. They make users more efficient at their existing jobs. When your product helps a procurement manager analyze suppliers faster, you're optimizing workflow execution. When an AI-native competitor's product recommends supplier contracts with 94% acceptance rates, they're owning the decision.

One approach sells "do your job better." The other sells "we do it for you."

The architectural requirements are completely different. Workflow optimization needs good UX and reliable APIs. Decision ownership needs proprietary data, learning loops, and accountability architecture.

| Dimension | Copilot (Workflow) | Captain (Decision) |

|---|---|---|

| Value Proposition | Helps users work faster | Makes decisions users trust |

| Intelligence Source | Shared foundation models | Proprietary data + models |

| Replication Barrier | Workflow understanding | Data access + model training |

| Customer DIY Risk | High (logic is visible) | Low (intelligence is hidden) |

| Switching Cost | Change management | Intelligence quality gap |

Why Faster Feature Shipping Makes It Worse

Each copilot feature you ship validates workflow simplicity to three audiences simultaneously.

To AI-native competitors, it confirms which workflows have market demand—they can build decision systems around the same use cases with cleaner architecture.

To platform providers, every API call teaches them your business model and customer patterns—intelligence they'll use to build competing features.

To customers, it demonstrates the workflow is simple enough that their product manager with Cursor might build something "good enough" over a weekend.

The companies shipping fastest within the feature paradigm are accelerating their own commoditization. They're winning the wrong race.

Three Transformation Shifts

The distinction between AI adoption and AI transformation comes down to three architectural shifts. Each changes what you're building, not just how fast you're building it.

Shift 1: Workflows → Decisions

From: "Help users complete tasks faster"

To: "Make decisions users trust without verification"

Workflow optimization improves efficiency within existing processes. Decision ownership changes the value exchange entirely. The customer no longer needs to do the job—your product does it for them.

A supply chain SaaS company I worked with made this shift concrete. Their legacy product helped procurement teams analyze supplier performance with dashboards, reports, and AI-generated summaries. Users still made every decision. Their transformed product recommends supplier contracts directly, with 94% of recommendations accepted without modification. Same domain, fundamentally different value proposition.

The transformation question: What decisions could your product own, rather than enable?

If you struggle to answer, you're in workflow optimization mode. If you have a clear list with measurable accuracy targets, you've identified transformation opportunities.

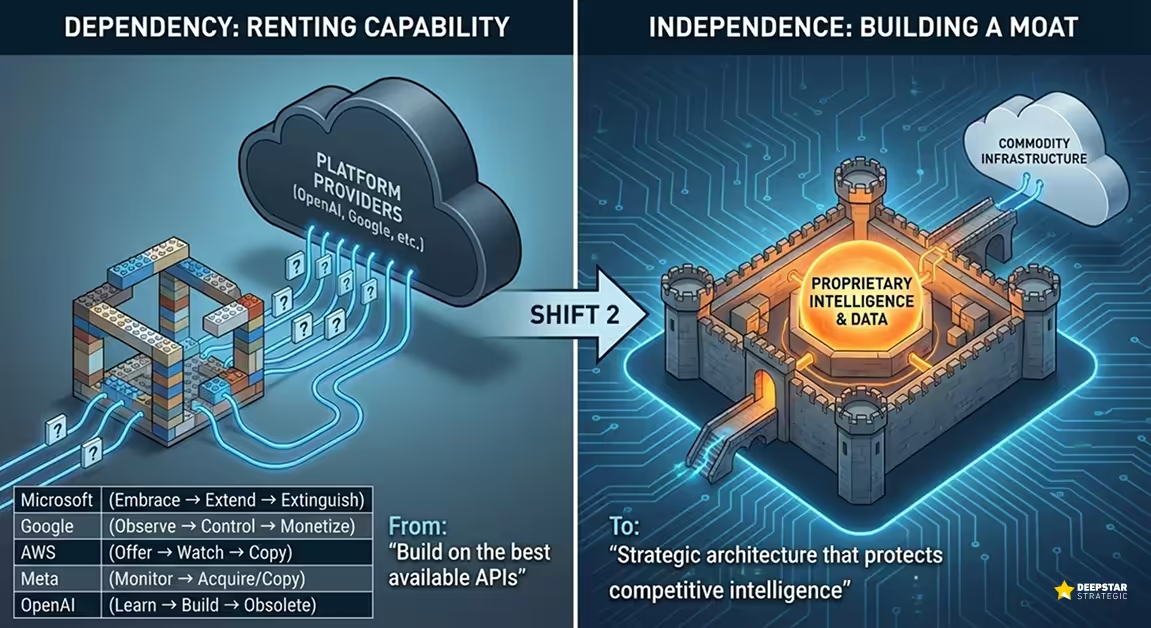

Shift 2: Dependency → Independence

From: "Build on the best available APIs"

To: "Strategic architecture that protects competitive intelligence"

The platform consolidation pattern has repeated five times in 30 years. Microsoft, Google, AWS, Meta, and now OpenAI—each cycle compressed the timeline.

| Platform | Consolidation Cycle | Timeline |

|---|---|---|

| Microsoft (1990s) | Embrace → Extend → Extinguish | 5-7 years |

| Google (2000s) | Observe → Control → Monetize | 4-6 years |

| AWS (2010s) | Offer → Watch → Copy | 3-5 years |

| Meta (2010s-20s) | Monitor → Acquire or Copy | 18-24 months |

| OpenAI (2024-25) | Learn → Build → Obsolete | 12-18 months |

Every API call to proprietary foundation models teaches platform providers your workflows. They see which features get the most usage, which prompts generate the most value, which patterns indicate successful products. When they see enough usage around a specific workflow, they build it natively. Your copilot feature becomes redundant overnight.

The companies that recognized the pattern early and architected for independence became category leaders. The companies that optimized within the Triple Squeeze became case studies in what not to do.

Platform independence doesn't mean zero foundation model usage. It means strategic choices about what intelligence stays proprietary versus what's delegated to commodity infrastructure. Use proprietary APIs for speed and capability. Build proprietary layers for differentiation and defense. Nations are investing billions to make these same architectural choices—France committed €109 billion because they recognized that dependency on external AI infrastructure is an existential risk, not a procurement issue.

The transformation question: What intelligence must stay proprietary versus what can you delegate to shared infrastructure?

If everything runs through OpenAI or Anthropic APIs with no proprietary intelligence layer, you're renting capability, not building it. If you can identify specific data assets, model customizations, or learning loops that create compounding advantages, you have foundation for a moat.

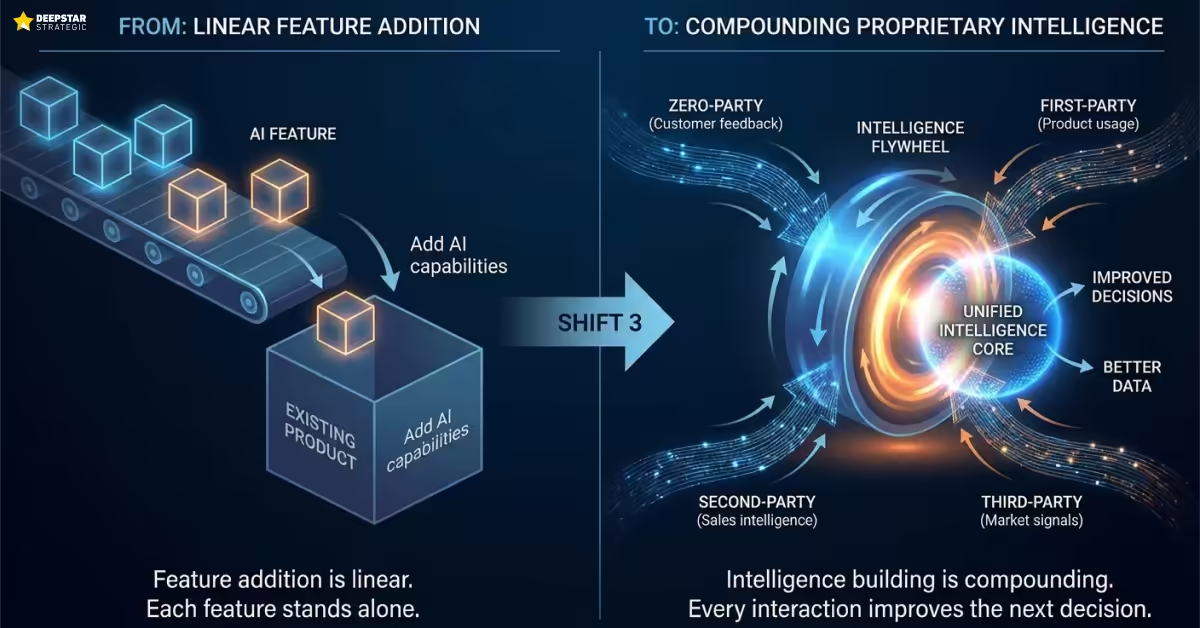

Shift 3: Features → Intelligence

From: "Add AI capabilities to existing product"

To: "Build proprietary intelligence that compounds with usage"

Feature addition is linear. You ship a capability, customers use it, you ship another. Each feature stands alone. Intelligence building is compounding. Every interaction generates data that improves the next decision, which generates better data, which improves subsequent decisions.

The intelligence flywheel connects four data sources most SaaS companies already have but don't unify:

| Data Type | Source | What It Reveals |

|---|---|---|

| Zero-party | Customer feedback | Needs, preferences, stated outcomes |

| First-party | Product usage | Behavioral patterns, workflow sequences |

| Second-party | Sales intelligence | Deal context, competitive signals, customer health |

| Third-party | Market signals | Industry trends, competitive movements, economic indicators |

Most companies treat these as separate data sources feeding separate systems. Marketing uses third-party data for targeting. Product uses first-party data for roadmap decisions. Sales uses second-party data for deal management. Nobody connects them into unified intelligence that feeds both product and GTM.

The transformation question: What data do you have that OpenAI doesn't?

If the answer is "nothing proprietary," you're building on shared infrastructure with no defensibility. If you can identify data sources, combinations, or insights that competitors and platform providers can't access, you have raw material for decision intelligence.

The Build/Buy Economics Question

This is why customers are building "good enough" replacements with Cursor and Lovable in 48 hours. Not because they want to—because your workflow-first architecture makes it possible.

When your product's value comes from workflow optimization rather than proprietary intelligence, "good enough" becomes achievable without your data. Your customer's product manager can describe the workflow, prompt an AI coding assistant, and get working code in an afternoon. Not production-grade. Not enterprise-scaled. But functional enough to question a six-figure renewal.

The test is simple: If a customer can describe the workflow and prompt Cursor to build a prototype, you're selling workflow optimization, not decision intelligence.

What can't be vibe-coded in a weekend:

Decision systems with proprietary data that took years to accumulate. Learning loops that improve accuracy with every interaction. Accountability architecture that makes AI decisions auditable and trustworthy. Domain-specific models fine-tuned on contexts customers can't access.

That's not a weekend project. That's years of data accumulation and architectural intent. The complexity isn't accidental—it's the moat.

The companies reporting lowest customer DIY exploration aren't shipping features faster. They're shipping capabilities customers can't replicate because the intelligence requires data only that product has accumulated.

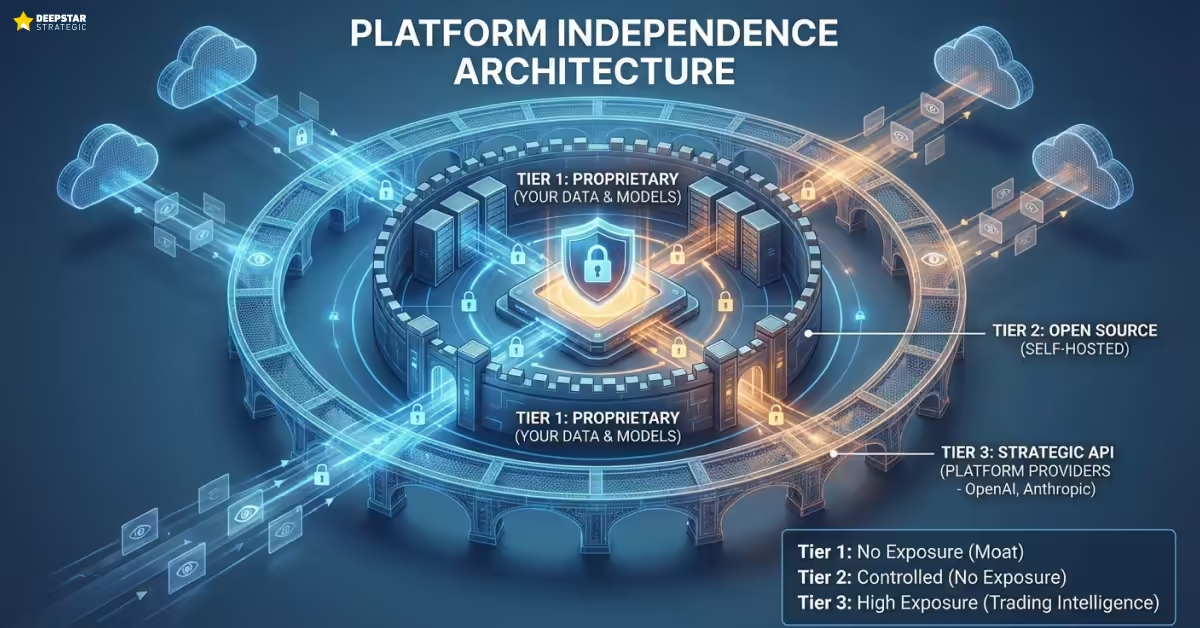

Platform Independence Architecture

The Mixpanel data breach revealed what platform dependency actually exposes. Usage patterns, customer segments, feature adoption, workflow sequences—competitive intelligence that teaches anyone watching exactly how your business works and where the value concentrates.

Every API call to proprietary foundation models creates the same exposure. Not through security breaches, but through the normal operation of the service. Platform providers see what you're building, how customers use it, and which patterns indicate success.

Model Selection as Strategic Architecture

Platform independence requires a three-tier model selection strategy:

| Tier | Strategy | When to Use | Platform Exposure |

|---|---|---|---|

| 1. Proprietary | Fine-tune models on your data | Decisions create competitive advantage | None—this is your moat |

| 2. Open Source | Self-host Llama, Mistral, etc. | Commodity capability, cost matters | None—you control everything |

| 3. Strategic API | OpenAI, Anthropic APIs | Speed, cutting-edge capability needed | High—trading intelligence for velocity |

The mistake most companies make is defaulting to Tier 3 for everything. It's fastest in the short term. It's most expensive strategically.

The Transformation Assessment

Three questions reveal whether you're architecting for independence or training your replacement.

Question 1: What decisions could your product own, rather than enable?

Write down every decision your users currently make with your product's help. Now identify which ones your product could make directly—with accuracy high enough that users trust the outcome without verification.

If your list is empty or vague, you're in workflow optimization mode. Your AI features help users work faster, but users still own every decision. You're vulnerable to AI-native competitors who own the decisions from day one.

If your list has concrete items with measurable accuracy targets, you've identified transformation opportunities. The question becomes sequencing and architecture.

Question 2: What intelligence do you have that platform providers don't?

List your proprietary data sources. Product usage telemetry. Customer feedback. Domain-specific training data. Historical decision patterns. Outcome measurements.

If your list is empty, you're renting intelligence. Every AI feature you ship runs on the same foundation models competitors and platform providers use. Your differentiation is UX and integration—both replicable within months.

If your list has concrete data assets, you have raw material for defensible AI. The question becomes whether you're actually using that data to build proprietary intelligence or just piping it through commodity APIs.

Question 3: What percentage of your AI features could customers replicate with Cursor and Claude?

Be honest. Go through your AI roadmap feature by feature. For each one, ask: could a reasonably technical customer describe this workflow and get working code from an AI coding assistant?

If the answer is "yes" for more than 70% of your features, you're building copilots that validate DIY replacement. Your architecture tells customers they don't need you.

If the answer is "no" for more than 70%—because the features require proprietary data, learning loops, or decision ownership customers can't replicate—you're building defensible decision systems.

The Copilot vs Captain Assessment

We built an assessment that categorizes up to 20 features from your AI roadmap as either copilots (workflow optimization vulnerable to commoditization) or captains (decision systems requiring proprietary intelligence).

The ratio reveals your architectural trajectory. Ninety percent copilots means you're optimizing within the squeeze. Shifting toward captains built on proprietary data means you're architecting for independence.

Five minutes for strategic clarity. No email required. No sales call. Just diagnostic clarity on whether your roadmap builds toward decision intelligence or optimizes workflows everyone can replicate.

The Transformation Path Forward

Transformation is harder than adoption. It requires architectural changes, not feature additions. It means rebuilding systems that currently work well enough. It means slowing feature velocity while you build foundation.

But transformation creates 2-3x valuation advantages while adoption creates temporary efficiency gains that commoditize within months.

The pattern from every previous platform consolidation cycle is consistent. The companies that recognized the architectural shift early—Snowflake building for multi-cloud before AWS lock-in became expensive, MongoDB maintaining open-source core while building managed services—became category leaders worth billions. The companies that optimized faster within the doomed paradigm got acquired at fractions of their potential value or shut down entirely.

The difference wasn't capability or resources. It was pattern recognition and architectural intent.

Here's what successful transformation actually looks like: you become essential business infrastructure. Not the best dashboard. Not the most AI features. A high-integrity service that both humans and agents rely on for canonical state, trusted decisions, and auditable outcomes. Your product becomes less about screens and more about being the authoritative source that everything else depends on.

This is why agent-addressability matters now, not later. As AI agents increasingly orchestrate workflows across multiple systems, the question shifts from "does this have the best interface?" to "is this the system easiest for agents to choreograph?" Products built as beautiful dashboards on top of inaccessible data will watch agents route around them entirely. Products built as high-integrity services with clean APIs, well-defined schemas, and queryable state become the infrastructure layer that captures the next generation of buyers—autonomous ones.

You have 12-18 months before architectural decisions become too expensive to change. After that, dependencies calcify. Codebases, team skillsets, customer expectations, and technical debt all optimize around the current paradigm. Migration becomes economically irrational.

The companies that transform early will lead the next cycle. The companies that optimize workflow features will train their replacement—through API calls that teach platform providers, through feature shipping that validates customer DIY, through architecture that AI-native competitors already surpassed.

For companies ready to build decision systems, we've documented the methodology for building decision intelligence that creates compounding advantages. The architecture that AI-native competitors already understand. The transformation path that turns the Triple Squeeze from existential threat into strategic opportunity.

Features don't defend. Decisions do.

Which architecture are you building?

Are You Building Copilots or Captains?Are You Building Copilots or Captains?

Assess whether your AI features optimize workflows anyone can copy or own decisions only you can make.

Let's Discuss Your AI StrategyLet's Discuss Your AI Strategy

30-minute discovery call to explore your AI transformation challenges, competitive positioning, and strategic priorities. No pressure—just a conversation about whether platform independence makes sense for your business.

Dive deeper into moving from AI Features to AI Transformation

Discover how to shift from feature parity to defensible competitive moats

From AI Features to AI TransformationBalancing Buy vs Build for Enterprise B2B SaaS: Live from Brisbane's Product Marketing Alliance Meetup

From AI Features to AI TransformationBalancing Buy vs Build for Enterprise B2B SaaS: Live from Brisbane's Product Marketing Alliance MeetupWhy buy vs build is shifting in enterprise SaaS and how modular integration drives 120% ACV growth.

Andrew Hatfield

Andrew HatfieldMay 7, 2024

From AI Features to AI TransformationHow Complex B2B SaaS Companies Are Growing By Modularising

From AI Features to AI TransformationHow Complex B2B SaaS Companies Are Growing By ModularisingWhy modular platforms are reshaping B2B SaaS growth—solving bounded problems instead of selling feature factories.

Andrew Hatfield

Andrew HatfieldApril 29, 2024

From AI Features to AI TransformationSegmentation driving 120% increase in ACV with rapid expansion revenue

From AI Features to AI TransformationSegmentation driving 120% increase in ACV with rapid expansion revenueHow Shippit achieved 120% ACV growth by refining segmentation and selling modules instead of monoliths.

Andrew Hatfield

Andrew HatfieldApril 9, 2024

From AI Features to AI TransformationHow saying NO is helping this SaaS vendor to 3x their growth

From AI Features to AI TransformationHow saying NO is helping this SaaS vendor to 3x their growthHow Rokt triples growth by making focused bets on modular platforms instead of building monolithic feature factories.

Andrew Hatfield

Andrew HatfieldApril 2, 2024