Why Your Customers Are Vibe Coding Replacements With Cursor and Lovable

Your customers aren't waiting for your roadmap anymore. They're building good enough replacements in hours, not months—and your workflow-first architecture is why.

Andrew Hatfield

November 16, 2025

The Churn Call That Reveals Your Architectural Vulnerability

Your product team shipped six AI features last quarter. Engineering integrated OpenAI for search, Anthropic for recommendations, Google for classification. The roadmap is aggressive. Velocity is strong.

Then your VP of Customer Success forwards an email from your largest account: "We prototyped something internally that handles most of what we need. Works well enough. We're evaluating whether to renew."

Not as polished as your product. Not as fully featured. But built in 48 hours by their product manager using Cursor and Lovable. Good enough to question a six-figure renewal.

This is the fundamental shift most product leaders haven't internalized: software has gone from hammer to scalpel. For decades, building software required teams, capital, and months of development—a blunt instrument that could only economically solve broad problems for large markets. Now software can be precisely crafted for a single customer's specific workflow in a weekend. The economics that made your product necessary have inverted.

That's not an outlier. It's the second squeeze—and most CPOs and CTOs are treating it as a customer execution problem when it's actually an architecture validation signal.

If your customers can build "good enough" versions of your product in days, your workflows are simpler than you think—and you're optimizing processes on infrastructure they can access directly.

The Democratization Nobody Saw Coming This Fast

AI coding assistants have compressed development timelines by 10-30x in less than 18 months.

Cursor grew from $1M to $100M revenue in a single year. GitHub Copilot crossed 20 million installs in mid-2025. Tools like Lovable, v0, Bolt, and Replit are giving product managers, analysts, and operations teams the ability to prototype functional applications in hours instead of months.

Vendr's 2025 SaaS Trends Report showed Cursor breaking into the top 10 net new software purchases—not developer tools generally, but all software purchases. Alongside GitHub's dominance in the development category, we're seeing AI-powered building capabilities become infrastructure-level technology adoption.

The capability expansion is exponential, not incremental. What used to require a development team, sprint planning, technical architecture discussions, and a six-month roadmap now happens in a weekend. Your customer's product manager prompts Cursor with "build a tool that extracts data from X, processes it through Y logic, and outputs Z format," and gets working code in an afternoon.

This precision enables something that wasn't economically viable before: custom software for micro-markets of one. Your product was built to serve thousands of customers with similar-enough workflows. Now each customer can build software that solves their exact problem—not the generalized version you built to serve the broader market. They don't need your 80% solution when they can build their 100% solution in 48 hours.

Not production-grade. Not enterprise-scaled. Missing the hardening, security rigor, comprehensive QA, scalability testing, and ongoing maintenance that professionally developed software requires.

But here's what makes this squeeze different from previous cycles: that's becoming irrelevant.

The enterprise is embracing "good enough" at unprecedented scale—driven by twin pressures to adopt AI capabilities and reduce costs. Companies are accepting technical debt and operational risk they would have rejected 18 months ago because the alternative is being perceived as slow to adopt AI transformation.

We're seeing this play out in engineering team economics. Over half of SaaS companies reduced headcount due to AI—with larger companies ($20M+ ARR) making reductions at higher rates than smaller ones. Engineering headcount specifically declined 2-5% year-over-year across early-stage companies.

Yet ARR per employee improvements tell a different story. While companies above $50M ARR saw ARR per employee increase 50% year-over-year (reaching nearly $400K per employee in the upper quartile), this came from aggressive cost reduction, not AI productivity gains. High Alpha's 2025 data shows teams are 25-59% smaller than four years ago, but the efficiency came from layoffs, not from AI tools multiplying individual productivity.

The economics are brutal: while R&D budgets declined from 36% to 27% of revenue between 2022-2024, AI infrastructure costs are rising. Companies reduce staff to cut costs, but end up redirecting those savings into AI spend—foundation model APIs, AI infrastructure, developer tooling. The budget freed from smaller teams gets consumed by AI capabilities that haven't yet delivered the promised productivity multiplier.

| Metric | Change (2020-2024) | What It Reveals |

|---|---|---|

| Companies reducing headcount due to AI | 50%+ | Cost cutting, not productivity gains |

| Engineering headcount (early stage) | Down 2-5% YoY | Aggressive staff reduction |

| Team size (all stages) | Down 25-59% over 4 years | Dramatic downsizing |

| ARR per employee ($50M+ companies) | Up 50% YoY ($400K upper quartile) | Efficiency from layoffs, not AI |

| R&D budget as % of revenue | Down from 36% to 27% | Budget pressure intensifying |

| AI infrastructure costs | Rising | Savings redirected to AI spend |

| Promised AI productivity multiplier | Not delivered | ROI gap widening |

Yet the build momentum continues accelerating.

The barrier is dropping even further. Previously, even a successfully prototyped internal tool required payment infrastructure complexity to become a monetizable service. Agent-native payment protocols like x402 now enable monetization with one line of code—turning weekend prototypes into revenue-generating agent services that can compete with your product for the same use cases.

The Build vs. Buy pendulum has swung dramatically—and understanding this history explains why customer DIY risk is intensifying now rather than stabilizing.

For decades, enterprises bought software because building was prohibitively expensive and slow. Then came the perfect storm: DevOps practices, Agile methodologies, cloud infrastructure, and containers with Kubernetes. Building became feasible. "We can build a better mousetrap" became the default response to vendor evaluations.

The build wave peaked in 2020-2022. Everyone had build teams. Every company was becoming a software company. Buy decisions faced intense scrutiny: "Why pay a vendor when we can build it ourselves?"

In 2023-2024, I watched this rebalance. Smarter, more nuanced decisions emerged. Companies recognized that building meant maintaining, that homegrown systems created hidden costs, that vendor expertise had value. Buy started competing more effectively against build.

Then AI coding assistants destroyed that rebalancing.

| Era | Dominant Pattern | Primary Driver | Typical Timeline |

|---|---|---|---|

| Pre-2015 | Buy over Build | Building prohibitively expensive | 6-12 months |

| 2015-2020 | Build wave begins | DevOps + Cloud + Kubernetes | 3-6 months |

| 2020-2022 | Build wave peaks | "Every company is a software company" | 2-4 months |

| 2023-2024 | Smart rebalancing | Recognition of maintenance costs | 3-6 months |

| 2024-2025 | Vibe coding destroys balance | Cursor, Lovable, bolt.new | 2-5 days |

This is the second squeeze in the Triple Squeeze pattern: while AI-native startups ship decision systems from day one and platform providers learn your workflows through API calls, your customers now have the tools to build "good enough" alternatives themselves. These three forces don't operate independently—they accelerate each other.

The timeline compression is what makes this squeeze different from previous low-code/no-code waves. Those tools took years to mature and months to implement. AI coding assistants are production-ready now, and their capabilities compound weekly as foundation models improve.

Lovable, v0, bolt.new, Replit, and Cursor—plus Claude Code, OpenAI Codex, and what's left of Windsurf—have enabled vibe coding. Non-technical users describe what they want in natural language and get functional applications. The technical barrier to building software has collapsed.

This surge is rewriting enterprise buying behavior in ways that directly threaten SaaS vendors. Your buyers aren't just evaluating whether your product solves their problem anymore. They're evaluating whether solving that problem requires buying anything at all.

And here's the compounding risk: your product is unlikely to solve your buyer's entire problem chain. Enterprise buyers face interconnected challenges that span multiple systems, workflows, and business processes. When they could only buy solutions, they accepted that reality and assembled best-of-breed tools. When they can rapidly prototype with AI, the calculus changes.

Now they're asking: "Can we build the connective tissue ourselves and only buy the truly complex pieces?"

This is where decision intelligence becomes your moat. Workflows are visible—customers can see the steps, understand the logic, and replicate "good enough" versions with vibe coding tools. But decision systems that own outcomes require proprietary intelligence customers can't easily replicate: data they don't have, models trained on contexts they can't access, decision accuracy that compounds through feedback loops they haven't built.

If your product's value comes from optimizing workflows, vibe coding tools have made that replicable. If your product's value comes from making decisions customers trust without verification—and improving those decisions through proprietary learning—you're building what AI coding assistants can't easily recreate.

The companies winning aren't trying to be platforms that solve everything. They're identifying which decisions they should own, building the proprietary data layers that make those decisions defensible, and ensuring clean interoperability for everything else in the buyer's stack—whether bought, built, or hybrid.

| Development Approach | Timeline | Skill Required | Output Quality | Hidden Costs |

|---|---|---|---|---|

| Traditional Development | 3-6 months | Senior engineers | Production-grade | Known, managed |

| Low-Code Platforms (2010s) | 4-8 weeks | Technical PMs | Prototype-to-MVP | Vendor lock-in |

| Vibe Coding (2024-25) | 2-5 days | Anyone who can describe logic | Good enough to validate | Technical debt deferred |

The gap between "describe the workflow" and "ship working software" has collapsed. And if your product's core value is workflow optimization, you've just validated that the workflow is simple enough to rebuild.

The enterprise reality check comes later—when prototypes need hardening for security compliance, when scale testing reveals performance issues, when the technical debt requires professional remediation. But by then, the buying decision has already been influenced. The perception that "we could probably build this" undermines your pricing power and elongates your sales cycles, even when the rational analysis would favor buying.

Your Copilot Features Are Teaching Customers How Replaceable You Are

Every copilot feature you ship that improves workflow efficiency also demonstrates workflow simplicity.

When you add an AI assistant that helps users complete tasks faster, you're showing them the workflow is understandable, codifiable, and optimizable through API calls. If Lovable and Cursor can help them build the tool, and your product proves the workflow works, what exactly are they paying you for?

The architecture vulnerability is structural:

Workflow optimization depends on user adoption and change management. The software helps people do their jobs better. Value comes from efficiency gains across many users over time. Switching costs come from training, habit formation, and integration into existing processes.

Decision intelligence depends on proprietary data and compounding learning. The software makes decisions and owns outcomes. Value comes from accuracy improvements that require data only you have. Switching costs come from the intelligence moat—competitors can't replicate what they can't access.

One is inherently vulnerable to DIY replacement. The other requires years of proprietary data accumulation to replicate.

Our September 2025 survey of B2B SaaS CPOs and CTOs found that 83% report high dependency on proprietary foundation model APIs for core product features. They're building copilot features on the same OpenAI, Anthropic, and Google infrastructure their customers can access directly.

The compounding cycle works like this:

| Stage | What Happens | Impact on You |

|---|---|---|

| 1. You ship a copilot | Feature uses foundation model APIs | Velocity feels strong |

| 2. Customers love it | Workflow efficiency improves | Adoption increases |

| 3. Validation signal | Feature demonstrates workflow is codifiable | You've shown them it's simple |

| 4. Realization | Customer sees they're paying for workflow optimization, not proprietary intelligence | Strategic vulnerability exposed |

| 5. DIY exploration | Customer prototypes with same foundation models you're using | "We could build this" |

| 6. "Good enough" | Working alternative emerges in days, not months | Competitive alternative exists |

| 7. Renewal risk | Six-figure contract under evaluation | Churn threat materializes |

Every workflow optimization feature you ship accelerates this cycle. You're not just adding value—you're teaching customers they can replicate that value independently.

The Strategic Signal You're Interpreting as Execution Noise

When a customer mentions they "built something internally," most product teams treat it as an isolated retention issue. Account management gets involved. Product demos upgraded features. Customer success offers additional training.

But customer DIY isn't a retention problem. It's a market signal that your value proposition is vulnerable to commoditization.

Think about what it means when customers can prototype working alternatives in 48 hours:

Your workflows are simpler than you think. If a product manager with Cursor can replicate core functionality over a weekend, the complexity you thought created switching costs is actually just friction. Customers tolerated the friction because no alternative existed. Now alternatives exist.

Your differentiation is shallower than you believe. The features you're shipping as competitive advantages are being validated as implementable by non-engineers with AI assistance. Differentiation through feature addition only works when features are hard to build. AI democratization makes most workflow features easy to build.

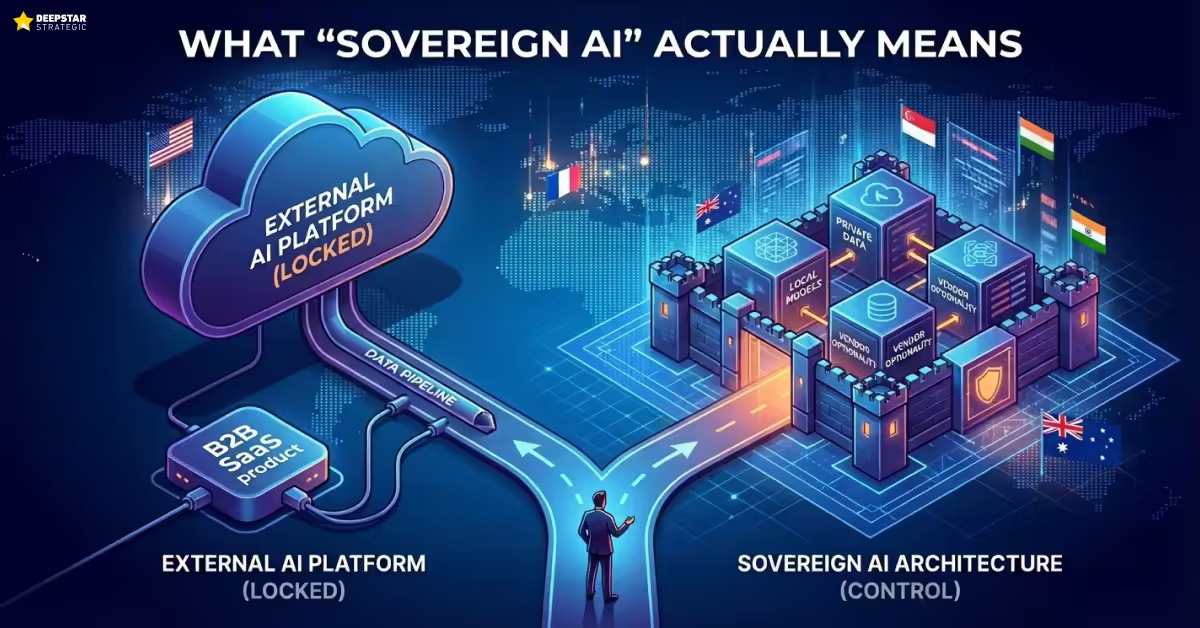

Your architecture reveals your vulnerability. If your AI capabilities depend on API calls to foundation models, and your customers have those same APIs, you're not building a moat. You're renting infrastructure and calling it differentiation. This is the same dependency pattern driving nations to invest billions in AI sovereignty—France committed €109 billion because they analyzed what happens when critical infrastructure is controlled by external parties. If governments see platform dependency as existential risk, your customers are running the same analysis on whether they need you.

This is the second threat in the Triple Squeeze pattern. AI-native startups are building decision systems from day one. Platform providers are learning your workflows from every API call. And now your customers can build "good enough" versions themselves.

Each squeeze accelerates the others. AI-native competitors make your workflow optimization look outdated. Customer DIY validates the workflows are simple enough to rebuild. Platform dependency means everyone—including your customers—has access to the same intelligence foundation.

The companies that recognize this pattern early are transforming architecture before the squeeze becomes inescapable. The companies treating it as isolated incidents are optimizing retention tactics while their strategic position erodes.

Why Decision Intelligence Creates Replacement Resistance

The contrast between workflow features and decision systems reveals why some software is vulnerable to DIY replacement while other software requires years to replicate.

Copilot features help users complete workflows faster. They reduce friction, suggest next steps, automate repetitive tasks, and optimize existing processes. They're valuable, but they're vulnerable because they're built on shared infrastructure and replicate visible workflows.

If your customer can see the workflow and articulate the steps, they can probably prompt Cursor to build "good enough." The logic is transparent. The APIs are accessible. The output is demonstrable.

Captain systems own decisions and deliver outcomes. They analyze context only you have, apply intelligence only you've built, make decisions users trust without verification, and improve continuously through proprietary learning loops. The three-layer architecture behind captain systems explains why they're hard to replicate.

If your customer wanted to replicate a captain system, at a minimum they'd need:

| Requirement | Available to Customer? | Time to Replicate |

|---|---|---|

| Proprietary data (product usage, customer feedback, market intelligence, historical patterns) | ❌ No | 2-3 years of accumulation |

| Trained models (fine-tuned on domain-specific contexts) | ❌ No | 6-12 months of iteration |

| Compounding intelligence (decision accuracy improving with every interaction) | ❌ No | Continuous learning required |

| Outcome ownership (trust built through proven decision quality) | ❌ No | Years of validation |

| Visible workflow logic | ✅ Yes | 2-5 days with Cursor/Lovable |

That's not a weekend project. That's years of data accumulation and model refinement.

The architectural difference is fundamental:

| Dimension | Copilot (Workflow) | Captain (Decision) |

|---|---|---|

| Primary Value | Helps users work faster | Makes decisions users trust |

| Intelligence Source | Shared foundation models | Proprietary data + models |

| Replication Barrier | Workflow understanding | Data access + model training |

| Customer DIY Risk | High (logic is visible) | Low (intelligence is hidden) |

| Switching Cost | Change management | Intelligence quality gap |

Our research found that companies building decision intelligence report significantly lower customer DIY exploration. When your product's value comes from proprietary intelligence rather than workflow optimization, "good enough" isn't achievable without your data.

One CPO at a supply chain SaaS company—when asked about customers building their own forecasting capabilities—explained the moat simply: their proprietary data and domain-specific models create such high barriers that customer DIY conversations end quickly once the actual requirements become clear.

That's decision intelligence protection. The complexity isn't accidental—it's the moat.

The Copilot vs. Captain Question Your Roadmap Needs to Answer

Most product teams haven't analyzed whether their AI features create compounding advantages or validate commoditization.

They're shipping based on customer requests, competitive parity pressure, and roadmap velocity without examining the architectural implications. Copilot feature after copilot feature, each one improving workflows and demonstrating replicability.

The strategic question isn't "are we shipping AI features fast enough?"

It's "are we building systems customers can't replicate with Cursor and Claude?"

Decision intelligence requires transformation, not just feature addition. You need:

Proprietary data strategies that capture intelligence competitors can't access. Zero-party data from customer feedback. First-party data from product usage. Second-party data from sales intelligence. Third-party data from market analysis. Connected in unified intelligence loops.

Architecture independence that protects competitive intelligence from platform learning. Not zero foundation model usage, but strategic choices about what intelligence stays proprietary versus what's delegated to APIs.

Decision ownership mindset that shifts from "help users work faster" to "make decisions users trust." Different value proposition. Different pricing models. Different competitive dynamics.

Most SaaS companies are optimizing for the first squeeze (AI-native competitive pressure) by shipping more copilot features faster. But faster copilot shipping accelerates the second squeeze by validating workflow simplicity to customers who have the same AI tools.

The companies architecting for independence are asking different questions: What decisions should we own? What intelligence is proprietary to us? What creates compounding advantages versus transient features?

We built an assessment that analyzes up to 20 features from your AI roadmap to determine whether you're building copilots or captains. It takes five minutes and reveals whether your architecture creates defensible advantages or validates DIY replication risk.

No email required. No sales call. Just diagnostic clarity on whether your roadmap is building toward decision intelligence or optimizing workflows that customers can rebuild with AI coding assistants.

Are You Building Copilots or Captains?Are You Building Copilots or Captains?

Assess whether your AI features optimize workflows anyone can copy or own decisions only you can make.

From Workflow Optimization to Decision Intelligence

Customer DIY through Cursor and Lovable isn't a customer education problem. It's an architecture signal.

When your customers can prototype "good enough" replacements in 48 hours, you're not selling proprietary intelligence. You're renting workflow optimization on shared infrastructure. The democratization of AI building capabilities has made that architectural choice visible.

The squeeze will intensify. AI coding assistants are improving weekly. Foundation models are getting more capable monthly. The gap between "describe the workflow" and "ship working software" continues to collapse.

The question facing every B2B SaaS product leader is whether you're architected for decision intelligence that compounds with usage, or workflow optimization that customers can replicate with tools they already have.

The companies that transform early will lead the next cycle. The companies that optimize workflow features will train their customers to replace them.

Which architecture are you building?

Let's Discuss Your AI StrategyLet's Discuss Your AI Strategy

30-minute discovery call to explore your AI transformation challenges, competitive positioning, and strategic priorities. No pressure—just a conversation about whether platform independence makes sense for your business.

Dive deeper into the state of SaaS in the age of AI

Understand the market forces reshaping SaaS—from platform consolidation to AI-native competition

The State of SaaS in the Age of AIThe Constraint Nobody's Modeling

The State of SaaS in the Age of AIThe Constraint Nobody's ModelingEvery AI sovereignty strategy makes the same assumption: when you're ready to build independence, the resources will be available. Analyze the economics and you'll find that assumption is wrong. Compute is concentrating. Talent is concentrating. Policy is unstable. The window is closing.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for Allies

The State of SaaS in the Age of AIThe Dependency Architecture Being Built for AlliesOpenAI's 'sovereign deployment options' sound like independence. The US government's AI Action Plan describes these as partnerships. Read the actual documents and you'll find explicit language about 'exporting American AI to allies.' That's not a sovereignty framework—it's a dependency architecture with better PR.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS Companies

The State of SaaS in the Age of AIWhat National AI Strategy Teaches SaaS CompaniesFrance, Singapore, India, and the UK collectively spent tens of millions developing AI sovereignty strategies. The conclusions are public. They translate directly to your product architecture decisions. Most SaaS product teams haven't read a single one.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product Strategy

The State of SaaS in the Age of AIWhat 'Sovereign AI' Actually Means for Your Product StrategyFrance is spending €109 billion on AI infrastructure. Singapore admits GPUs are in short supply and they face 'intense global competition' to access them. Your product team is debating whether to increase OpenAI API spend by 20%. These aren't different conversations—they're the same conversation at different scales.

Andrew Hatfield

Andrew HatfieldDecember 9, 2025